Wells Fargo CD Rate Alert

In a new article by American Banker... https://www.americanbanker.com/news/regionals-pick-their-battlefields-in-fight-for-deposits they report that...

1) Large and regional banks have finally been forced to pay up for retail deposits after lagging the rest of the industry for months.

2) Deposits are the cheapest source of fuel for loan growth.

3) Citigroup CFO states retail deposit betas to increase in the second half of the year.

4) A Novantas director said "Materially all of the retail deposit growth at this point is coming in CDs. Sitting out of CDs entirely may mean very low, potentially even flat or negative overall retail deposit growth."

------------------------------

Neil Stanley

President of Community Banking

TS Banking Group

Treynor, Iowa

------------------------------

-------------------------------------------

Original Message:

Sent: 08-22-2018 15:30

From: Neil Stanley

Subject: Wells Fargo CD Rate Alert

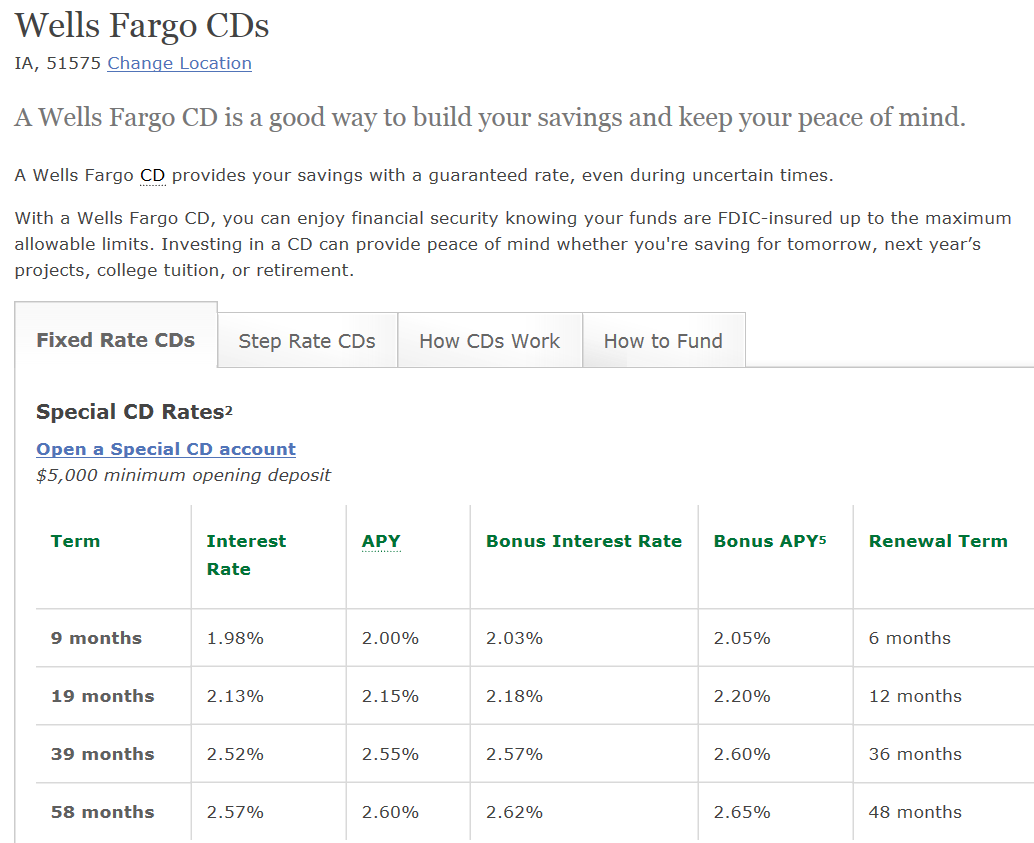

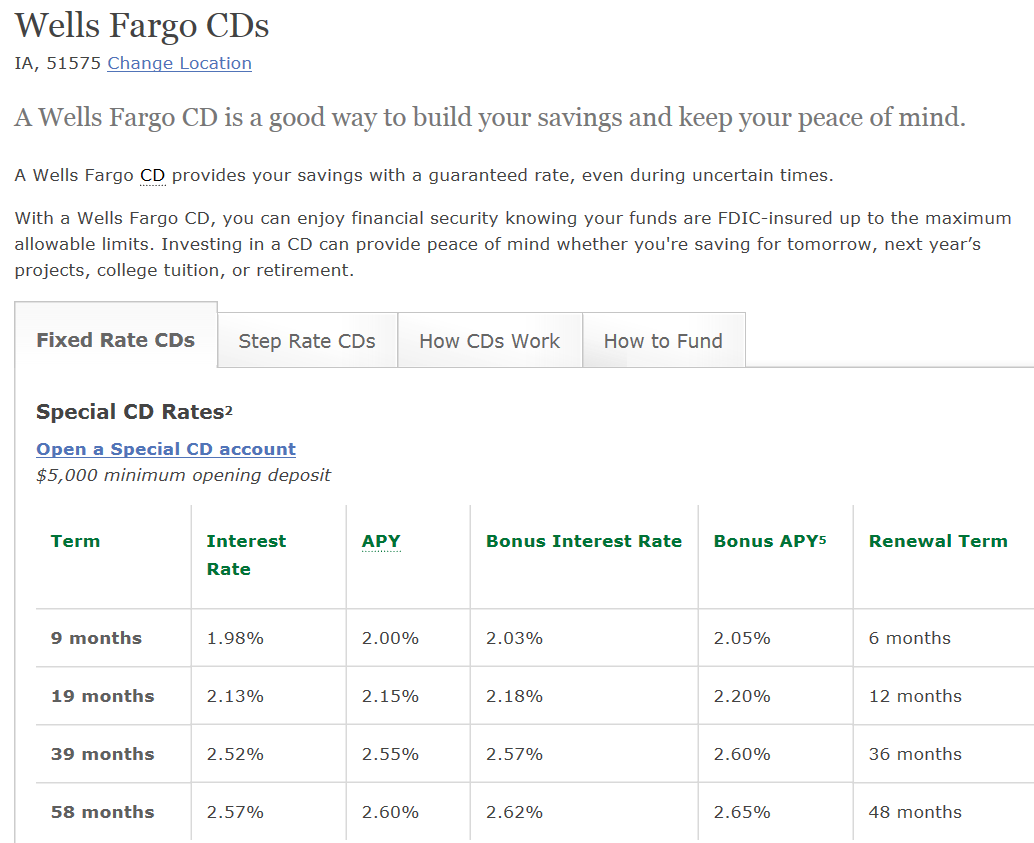

For the last decade JP Morgan, Bank of America, Wells Fargo, and Citibank deposit offerings left plenty of room for pricing discretion by community banks. Here in this market we can see clearly now that the game has changed. Below is what Wells Fargo is offering in western Iowa on their public website today. When a major bank prices like this we know that the days of focusing only on the online banks and local community financial institution competitors are gone. Every pricing manager must take the time to look again at your local rate survey analysis. Now it is not just what rates are being offered, but who is offering those aggressive promotions. It is reasonable to determine that more competitive deposit offerings from the major banks will have a much larger impact on the movement of deposit funds. With the major banks' abilities to market and promote you can be assured that the depositors who are not rate sensitive will soon be checking their options for long-term savings. This is one solid signal that history might record that mid-2018 marks the end of any remaining elements of the "cease fire" for deposits with financial institutions of all dimensions now fully engaged in the battle.

------------------------------

Neil Stanley

President of Community Banking

TS Banking Group

Treynor, Iowa

------------------------------

1) Large and regional banks have finally been forced to pay up for retail deposits after lagging the rest of the industry for months.

2) Deposits are the cheapest source of fuel for loan growth.

3) Citigroup CFO states retail deposit betas to increase in the second half of the year.

4) A Novantas director said "Materially all of the retail deposit growth at this point is coming in CDs. Sitting out of CDs entirely may mean very low, potentially even flat or negative overall retail deposit growth."

------------------------------

Neil Stanley

President of Community Banking

TS Banking Group

Treynor, Iowa

------------------------------

-------------------------------------------

Original Message:

Sent: 08-22-2018 15:30

From: Neil Stanley

Subject: Wells Fargo CD Rate Alert

For the last decade JP Morgan, Bank of America, Wells Fargo, and Citibank deposit offerings left plenty of room for pricing discretion by community banks. Here in this market we can see clearly now that the game has changed. Below is what Wells Fargo is offering in western Iowa on their public website today. When a major bank prices like this we know that the days of focusing only on the online banks and local community financial institution competitors are gone. Every pricing manager must take the time to look again at your local rate survey analysis. Now it is not just what rates are being offered, but who is offering those aggressive promotions. It is reasonable to determine that more competitive deposit offerings from the major banks will have a much larger impact on the movement of deposit funds. With the major banks' abilities to market and promote you can be assured that the depositors who are not rate sensitive will soon be checking their options for long-term savings. This is one solid signal that history might record that mid-2018 marks the end of any remaining elements of the "cease fire" for deposits with financial institutions of all dimensions now fully engaged in the battle.

------------------------------

Neil Stanley

President of Community Banking

TS Banking Group

Treynor, Iowa

------------------------------

0 Comments

Join the Conversation! 🗣️✨

Be part of our community—sign up now to share your thoughts, connect with others, and stay in the loop!