[Webinar] Why Now Is the Time to Lock in Cheap Funding

Thanks Rob,

This is a great topic for all of us to consider. The spread between bank deposit offering rates and the wholesale market has grown dramatically in 2022 and bankers are wisely choosing to keep deposit rates low given the surplus of deposits as we respect the loan/deposit ratios. But the wisest bankers are finding ways of not letting what have become highly profitable term deposits leave. The days of treating term deposits like they are a burden are in the rearview mirror.

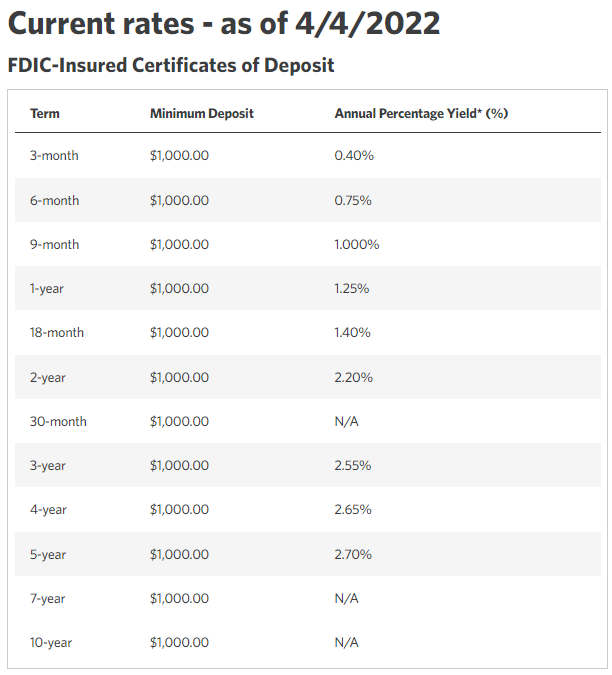

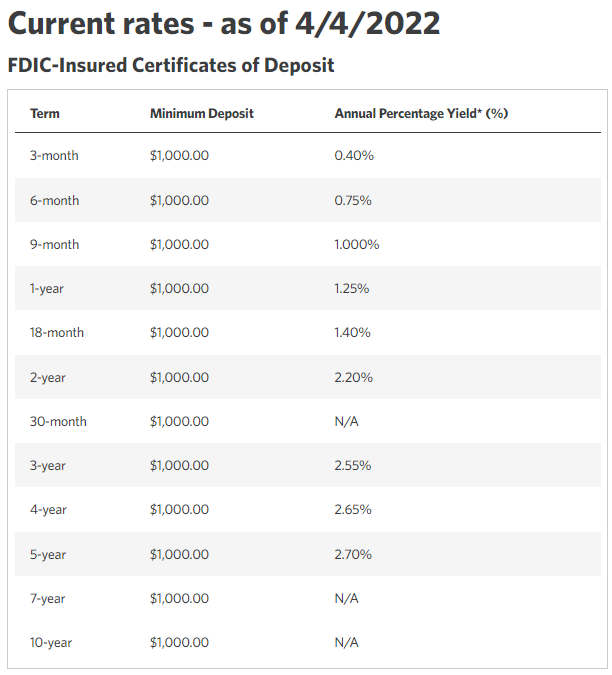

If you want a glimpse of the future check out the current Edward Jones deposit offering rates that are available to your depositors today in your community at https://www.edwardjones.com/us-en/market-news-insights/stock-market-news/current-rates

------------------------------

Neil Stanley

------------------------------

-------------------------------------------

Original Message:

Sent: 04-04-2022 16:06

From: Rob Blackwell

Subject: [Webinar] Why Now Is the Time to Lock in Cheap Funding

------------------------------

Rob Blackwell

Chief Content Officer and Head of External Affairs

IntraFi Network

Arlington, VA

------------------------------

This is a great topic for all of us to consider. The spread between bank deposit offering rates and the wholesale market has grown dramatically in 2022 and bankers are wisely choosing to keep deposit rates low given the surplus of deposits as we respect the loan/deposit ratios. But the wisest bankers are finding ways of not letting what have become highly profitable term deposits leave. The days of treating term deposits like they are a burden are in the rearview mirror.

If you want a glimpse of the future check out the current Edward Jones deposit offering rates that are available to your depositors today in your community at https://www.edwardjones.com/us-en/market-news-insights/stock-market-news/current-rates

------------------------------

Neil Stanley

------------------------------

-------------------------------------------

Original Message:

Sent: 04-04-2022 16:06

From: Rob Blackwell

Subject: [Webinar] Why Now Is the Time to Lock in Cheap Funding

Last chance to register! Don't forget to sign up for our webinar this Wednesday, April 6 at 2:00 PM ET, where Scott Hildenbrand, Chief Balance Sheet Strategist and Head of Financial Strategies at Piper Sandler, will be sitting down with me to discuss how banks can seize opportunities in today's low-rate environment before they're gone-and why waiting just isn't an option.<o:p></o:p>

<o:p></o:p>

------------------------------

Rob Blackwell

Chief Content Officer and Head of External Affairs

IntraFi Network

Arlington, VA

------------------------------

0 Comments

Join the Conversation! 🗣️✨

Be part of our community—sign up now to share your thoughts, connect with others, and stay in the loop!