Tuesday Topic: The Buy Now Pay Later Revolution

I think BNPL is a good solution for consumers who don't have credit cards but a bad solution if it simply adds on to the consumers existing credit card debt. If used in moderation comes to mind.

We hope your car takes you on some wonderful trips!

------------------------------

John Tyson

CFO/SVP

Altamaha Bank & Trust Company

Vidalia, GA

------------------------------

-------------------------------------------

Original Message:

Sent: 04-26-2021 13:01

From: Barb Rehm

Subject: Tuesday Topic: The Buy Now Pay Later Revolution

I started noticing "Buy Now Pay Later" offers last year and thought, "In this tech-focused market, how is that old way of buying stuff making a comeback?" I didn't realize then that it's the fintech financial providers that resurrected the idea and made it their own. Buy Now Pay Later is so widely accepted that it now merely goes by the acronym BNPL. While a small slice of the consumer finance market today, BNPL is growing.

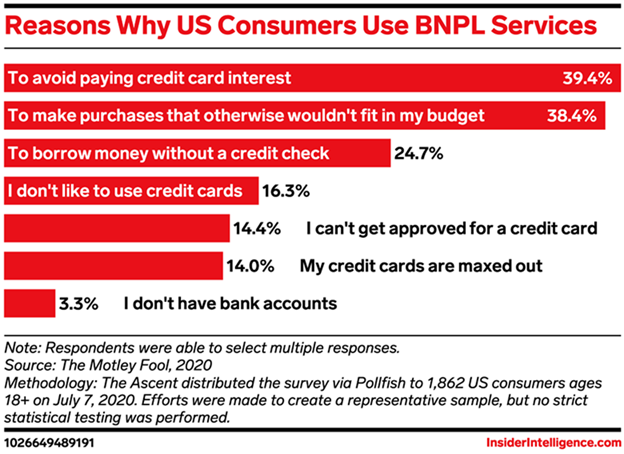

Do you see this as a competitive threat? Will you offer BNPL? And more broadly, do you think this is a good product for consumers? I worry about reason #2 below from a Business Insider story…that BNPL encourages people to spend money they don't have. Please share your thoughts on BNPL.

NOTE: There will be no Weekly News Roundup this week or Tuesday Topic next week. I'm taking my new car on a road trip!

------------------------------

Barb Rehm

Senior Managing Director

IntraFi Network

Arlington VA

------------------------------