Loan Pricing Strategy

Neil,

We've been beating that drum for months but it's a challenge with the pace of these rate hikes. We're celebrating when our average booked loans for the month are above whatever the new Prime Rate is at the end of that month. And we know that is not keeping up with the speed of the rate hikes. We have moved beyond 4% but unfortunately we have many of our largest borrowers with those rates right now.

------------------------------

John Tyson

CFO;Chief Financial Officer

Altamaha Bank & Trust Company

Vidalia, GA

------------------------------

-------------------------------------------

Original Message:

Sent: 09-25-2022 14:23

From: Neil Stanley

Subject: Loan Pricing Strategy

How have you adjusted lender pricing expectations? Strategy is about anticipation and action. We can clearly see now where the Fed is determined to take interest rates. Seems that to the mantra - "Don't Fight the Fed" we could easily add "While They Are Determined to Fight Inflation".

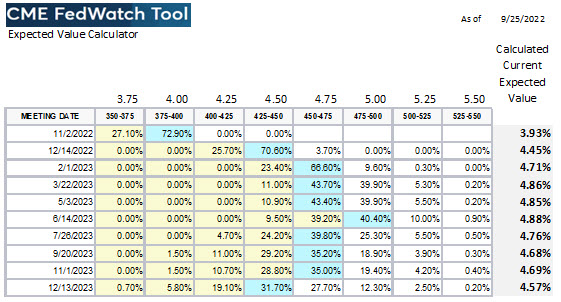

With the Fed Funds futures market currently predicting that overnight Fed Funds will plateau in 2023 between 4.50% and 5.00% how have you informed lenders and got their buy-in for properly priced loan rates? Any loan that is more than 3-months to maturity is now expected to be accruing in this new rate environment when official prime can be expected to be in the 7.50- 8% range.

Source: CME FedWatch Tool: Countdown to FOMC - CME Group

Source: CME FedWatch Tool: Countdown to FOMC - CME Group

The bank no longer needs to pay a lender or take credit or interest rate risks to get 4% yields. What are you doing to get appropriate loan pricing in place?

------------------------------

Neil Stanley

------------------------------

We've been beating that drum for months but it's a challenge with the pace of these rate hikes. We're celebrating when our average booked loans for the month are above whatever the new Prime Rate is at the end of that month. And we know that is not keeping up with the speed of the rate hikes. We have moved beyond 4% but unfortunately we have many of our largest borrowers with those rates right now.

------------------------------

John Tyson

CFO;Chief Financial Officer

Altamaha Bank & Trust Company

Vidalia, GA

------------------------------

-------------------------------------------

Original Message:

Sent: 09-25-2022 14:23

From: Neil Stanley

Subject: Loan Pricing Strategy

How have you adjusted lender pricing expectations? Strategy is about anticipation and action. We can clearly see now where the Fed is determined to take interest rates. Seems that to the mantra - "Don't Fight the Fed" we could easily add "While They Are Determined to Fight Inflation".

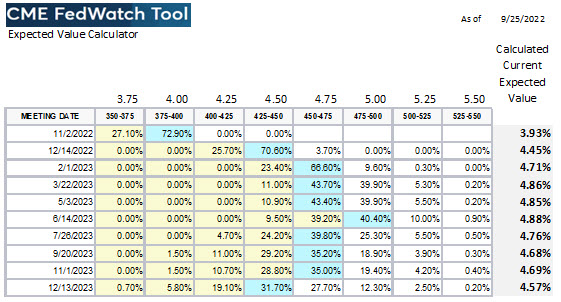

With the Fed Funds futures market currently predicting that overnight Fed Funds will plateau in 2023 between 4.50% and 5.00% how have you informed lenders and got their buy-in for properly priced loan rates? Any loan that is more than 3-months to maturity is now expected to be accruing in this new rate environment when official prime can be expected to be in the 7.50- 8% range.

Source: CME FedWatch Tool: Countdown to FOMC - CME Group

Source: CME FedWatch Tool: Countdown to FOMC - CME GroupThe bank no longer needs to pay a lender or take credit or interest rate risks to get 4% yields. What are you doing to get appropriate loan pricing in place?

------------------------------

Neil Stanley

------------------------------

0 Comments

Join the Conversation! 🗣️✨

Be part of our community—sign up now to share your thoughts, connect with others, and stay in the loop!