Last Week's Most Popular Stories

------------------------------

Neil Stanley

------------------------------

-------------------------------------------

Original Message:

Sent: 04-19-2024 14:46

From: Rob Blackwell

Subject: Last Week's Most Popular Stories

The most popular posts among Peer Intelligence participants for the week ended April 19 discussed deposit rates, efforts to combat check fraud, and FHLB advances to troubled banks. If you missed any of these, you may check them out below. Thanks for reading.

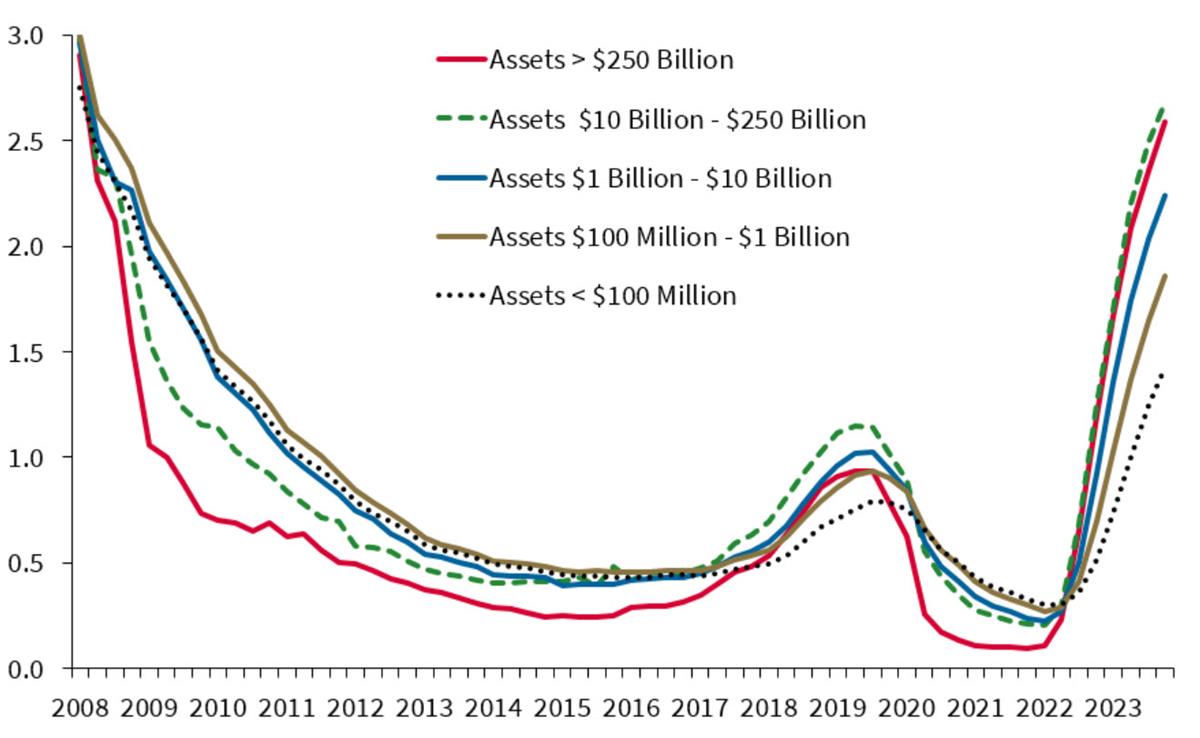

"Will Banks Finally Have to Pay You More for Your Savings?"

"Community Banks are Fighting Check Fraud on the Front Lines"

"New Details on Rush of Home Loan Bank Borrowings at Three Failed Banks"

Did you miss our most recent Banking with Interest podcast with Mark Calabria, former director of the Federal Housing Finance Agency, and Aaron Klein, senior fellow at the Brookings Institution? Check it out here.

------------------------------

Rob Blackwell

Chief Content Officer and Head of External Affairs

IntraFi

Arlington, VA

------------------------------