How is This Sustainable?

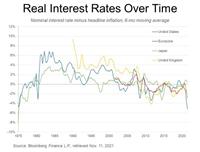

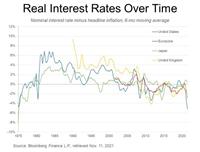

I agree this is not sustainable. Interest rates being low for so many years coupled with the recent stimulus and near zero interest rate benchmarks has upset the scales of economic principles. Before reaching a new equilibrium, a bubble will need to burst. Below is a link to an ABA article, reflecting the real interest rate of negative 6%. The rise of equity markets over the past few decades can thank the fiscal policies. However, we are at a crossroads where this economic approach will cause significant corrections. The corrections will be swift and disruptive. Unlike historical economic cycles, the evolution of the Information Age and social media leads to quicker, more drastic corrections.

Behind the Headlines on Real Interest Rates | ABA Banking Journal

------------------------------

Matt Johnson

CFO

Premier Bank

Omaha, NE

Posts reflect my personal opinion and do not represent any organization in which I am affiliated.

------------------------------

-------------------------------------------

Original Message:

Sent: 11-15-2021 16:09

From: Neil Stanley

Subject: How is This Sustainable?

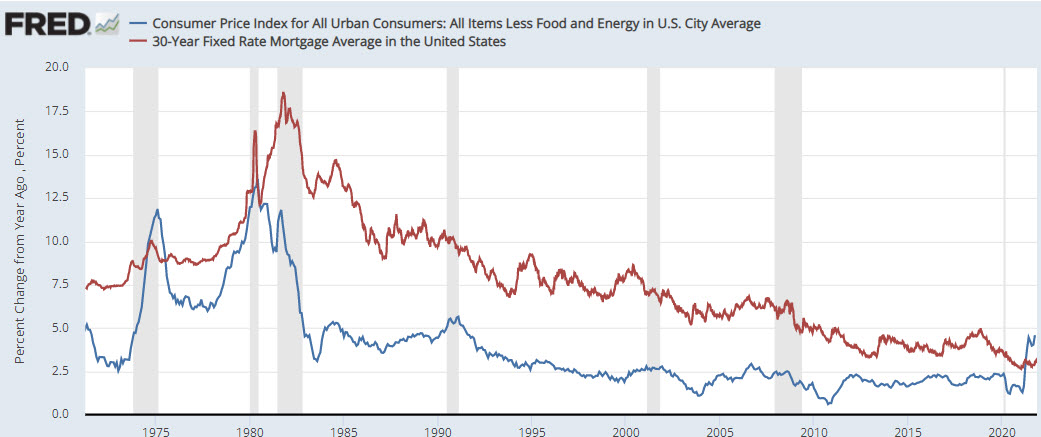

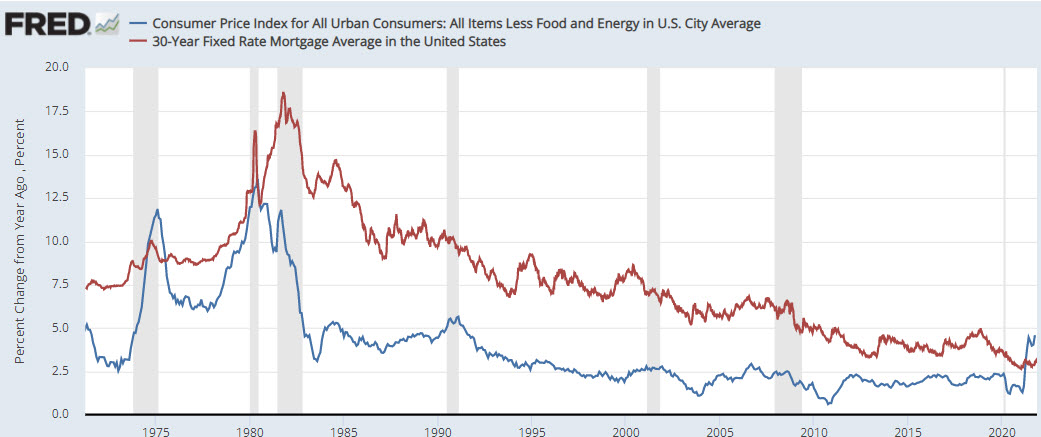

The U.S. Inflation Rate is Higher than 30-year Mortgage Rates

https://fred.stlouisfed.org/graph/?g=ITgr

Only 3% of the time over the past 50 years has this occurred. If this is not sustainable how will we achieve a new equilibrium? Will inflation drop in spite of all of the fiscal and monetary stimulus; will interest rates go up; some of each; or have we found the tree that grows money?

------------------------------

Neil Stanley

------------------------------

Behind the Headlines on Real Interest Rates | ABA Banking Journal

------------------------------

Matt Johnson

CFO

Premier Bank

Omaha, NE

Posts reflect my personal opinion and do not represent any organization in which I am affiliated.

------------------------------

-------------------------------------------

Original Message:

Sent: 11-15-2021 16:09

From: Neil Stanley

Subject: How is This Sustainable?

The U.S. Inflation Rate is Higher than 30-year Mortgage Rates

https://fred.stlouisfed.org/graph/?g=ITgr

Only 3% of the time over the past 50 years has this occurred. If this is not sustainable how will we achieve a new equilibrium? Will inflation drop in spite of all of the fiscal and monetary stimulus; will interest rates go up; some of each; or have we found the tree that grows money?

------------------------------

Neil Stanley

------------------------------

0 Comments

Join the Conversation! 🗣️✨

Be part of our community—sign up now to share your thoughts, connect with others, and stay in the loop!