Given the banking industry's anxiety about margin compression...

How could loan yields reported for the first quarter of 2024 have been managed in such a way that they declined compared to the previous quarter?

Could it be that the industry was better positioned to avoid mispricing loans years ago? How is it that cost of funds peaked at such a higher cost years ago compared to today's cost of funding. Is cost of funds destined to rise more or are depositors going to accept much less value for their deposits relative to Fed Funds today? So many questions arise when you probe this data!

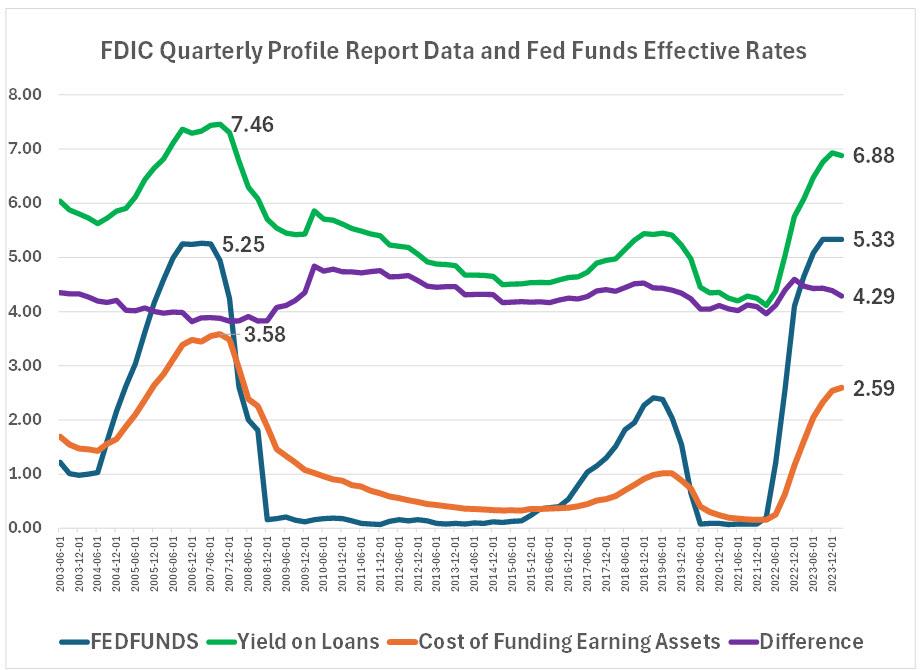

The graphic plots Effective Fed Funds for the last month of the quarter from the Federal Reserve alongside yields reported for the quarter by the FDIC. The loan and cost of funding earning assets data can be found in the FDIC Quarterly Profile at https://www.fdic.gov/analysis/quarterly-banking-profile/qbp/timeseries/ratios-by-asset-size-group.xlsx This data shows the loan yields for all banks dropped from 6.93% to 6.88% over the most recent quarter. You can see the changes by each asset size group. The only one that went up was for banks between $100 million and $1 billion and they are still the lowest at 6.19%.

Could it be that the industry was better positioned to avoid mispricing loans years ago? How is it that cost of funds peaked at such a higher cost years ago compared to today's cost of funding. Is cost of funds destined to rise more or are depositors going to accept much less value for their deposits relative to Fed Funds today? So many questions arise when you probe this data!

The graphic plots Effective Fed Funds for the last month of the quarter from the Federal Reserve alongside yields reported for the quarter by the FDIC. The loan and cost of funding earning assets data can be found in the FDIC Quarterly Profile at https://www.fdic.gov/analysis/quarterly-banking-profile/qbp/timeseries/ratios-by-asset-size-group.xlsx This data shows the loan yields for all banks dropped from 6.93% to 6.88% over the most recent quarter. You can see the changes by each asset size group. The only one that went up was for banks between $100 million and $1 billion and they are still the lowest at 6.19%.

------------------------------

Neil Stanley

------------------------------

0 Comments

Join the Conversation! 🗣️✨

Be part of our community—sign up now to share your thoughts, connect with others, and stay in the loop!