Giant Sucking Sound?

I did a little research on the 3/2022 call report data and found that the median industry level of Non-Transaction Public Fund Deposits to Total Assets was 2.47%. 25% of banks have Non-Transaction Public Fund Deposits equal to or greater than 5.62 of Total Assets%. 10% have Non-Transaction Public Fund Deposits equal to or greater than 9.76% of Total Assets. Only 435 banks reported no Non-Transaction Public Fund Deposits.

------------------------------

Neil Stanley

------------------------------

-------------------------------------------

Original Message:

Sent: 06-10-2022 11:32

From: Neil Stanley

Subject: Giant Sucking Sound?

30 years ago, presidential candidate Ross Perot used the phrase "Giant Sucking Sound" to focus attention on the expectation of coming economic changes.

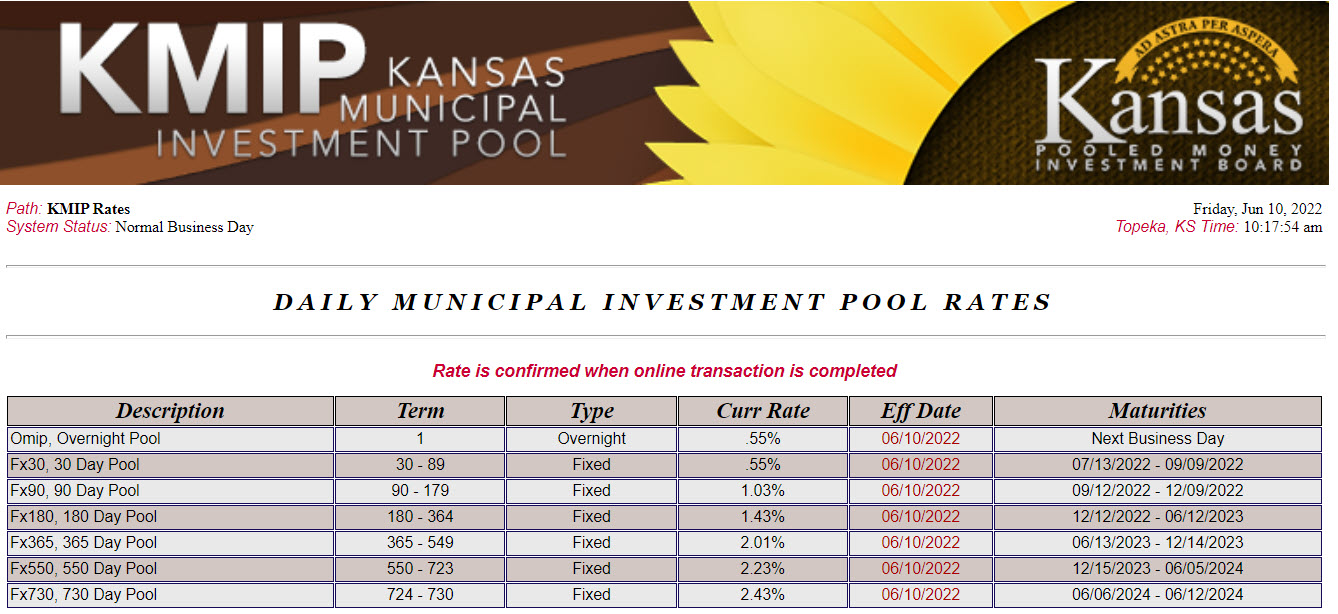

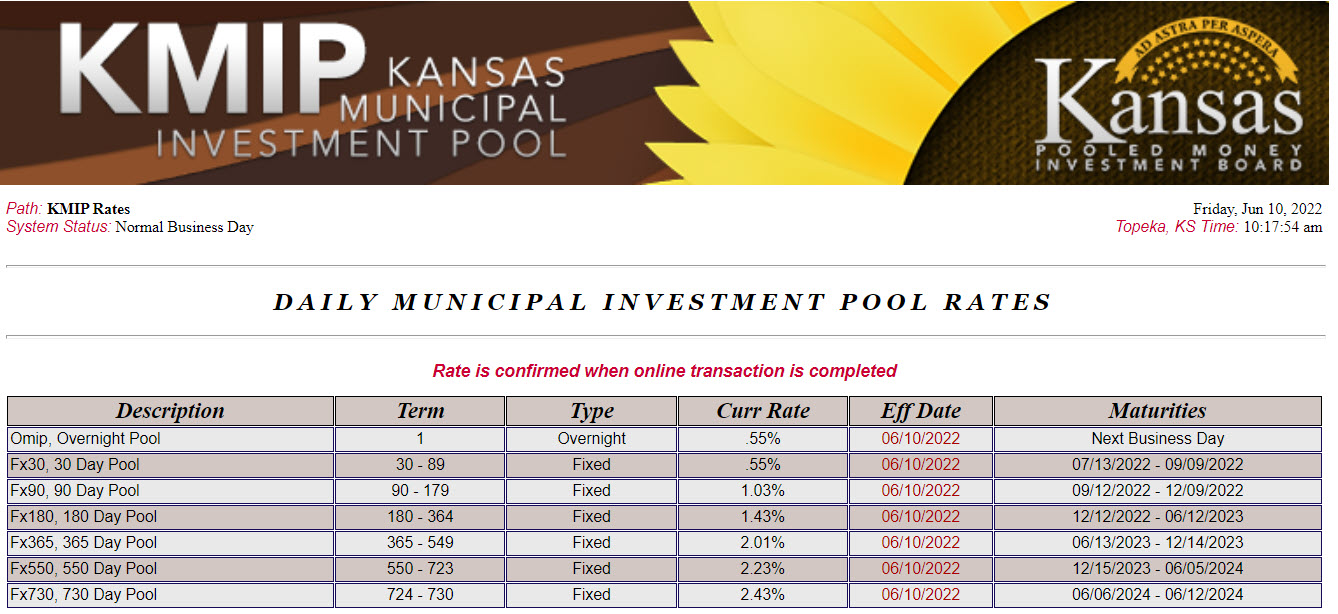

Today, I am curious how many bankers are hearing this sound now or can see it coming in regard to public deposits. Bankers in recent weeks have been telling me that their public fund deposits are in play. With entities like the Kansas Municipal Investment Pool offering dramatically higher interest rates after just two rate increase by the Federal Reserve since 2020. https://host.treasurer.state.ks.us/kmip_rates.php

Are there any states or regions of our country in which this type of public depository option is not available, common, or even feasible? How does the pricing available in my example above for Kansas compare to what is available in your area?

Do you anticipate that public funds will be sucked away from your operation? Anyone want to share their strategies for addressing the exodus of public fund deposits?

------------------------------

Neil Stanley

------------------------------

------------------------------

Neil Stanley

------------------------------

-------------------------------------------

Original Message:

Sent: 06-10-2022 11:32

From: Neil Stanley

Subject: Giant Sucking Sound?

30 years ago, presidential candidate Ross Perot used the phrase "Giant Sucking Sound" to focus attention on the expectation of coming economic changes.

Today, I am curious how many bankers are hearing this sound now or can see it coming in regard to public deposits. Bankers in recent weeks have been telling me that their public fund deposits are in play. With entities like the Kansas Municipal Investment Pool offering dramatically higher interest rates after just two rate increase by the Federal Reserve since 2020. https://host.treasurer.state.ks.us/kmip_rates.php

Are there any states or regions of our country in which this type of public depository option is not available, common, or even feasible? How does the pricing available in my example above for Kansas compare to what is available in your area?

Do you anticipate that public funds will be sucked away from your operation? Anyone want to share their strategies for addressing the exodus of public fund deposits?

------------------------------

Neil Stanley

------------------------------

0 Comments

Join the Conversation! 🗣️✨

Be part of our community—sign up now to share your thoughts, connect with others, and stay in the loop!