Fed Tightening Curbs Banks' Appetite for Bonds in Q1

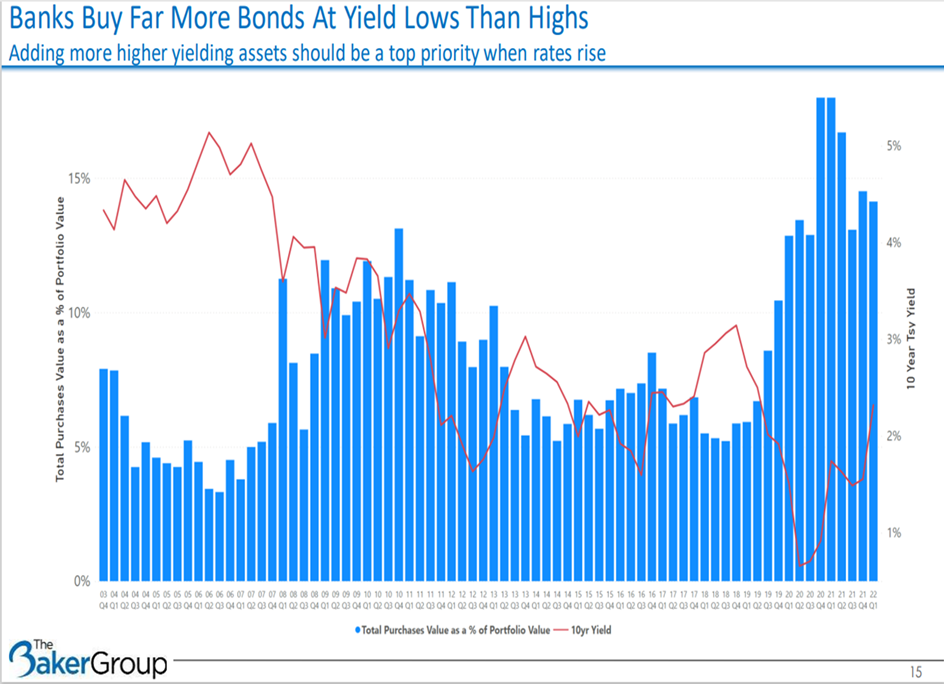

The Baker Group had an interesting graph from one of their presentations

that I think captures the history of bankers in rising rates. Hard to make yourself

continue to buy on the way up, when what you have bought is going down in value.

Takes a contrarian mindset, a defined plan, and a stomach/nerves of steel. If it was

the stock market would say "look at all these beautiful stocks on sale." ��

NOTICE: This electronic mail message and any files transmitted with it are intended exclusively for the individual or entity to which it is addressed. The message, together with any attachment, may contain confidential and/or privileged information. Any unauthorized review, use, printing, saving, copying, disclosure or distribution is strictly prohibited. If you have received this message in error, please immediately advise the sender by reply email and delete all copies.

-------------------------------------------

Original Message:

Sent: 7/6/2022 12:09:00 PM

From: Barb Rehm

Subject: Fed Tightening Curbs Banks' Appetite for Bonds in Q1

This week's post from S&P Global Market Intelligence shows tighter monetary policy led banks to invest less cash in bonds during the first quarter. Bank bond portfolios shrunk to 26.1% of assets, with banks favoring bonds with shorter maturities. See how your bond strategy compares with the industry's at large.<o:p></o:p>

------------------------------

Barb Rehm

Senior Managing Director

IntraFi Network

Arlington VA

------------------------------

0 Comments

Join the Conversation! 🗣️✨

Be part of our community—sign up now to share your thoughts, connect with others, and stay in the loop!