Efficiency Ratios Continue Negative Trend

Barb, as we all know, revenue growth is a bigger driver of lower efficiency ratios than cost cutting (and a lot more rewarding). I just don't see how efficiency ratios don't continue climbing in this environment as revenue growth is such a challenge.

------------------------------

John Tyson

CFO/SVP

Altamaha Bank & Trust Company

Vidalia, GA

------------------------------

-------------------------------------------

Original Message:

Sent: 03-10-2021 13:12

From: Barb Rehm

Subject: Efficiency Ratios Continue Negative Trend

------------------------------

Barb Rehm

Senior Managing Director

IntraFi Network

Arlington VA

------------------------------

------------------------------

John Tyson

CFO/SVP

Altamaha Bank & Trust Company

Vidalia, GA

------------------------------

-------------------------------------------

Original Message:

Sent: 03-10-2021 13:12

From: Barb Rehm

Subject: Efficiency Ratios Continue Negative Trend

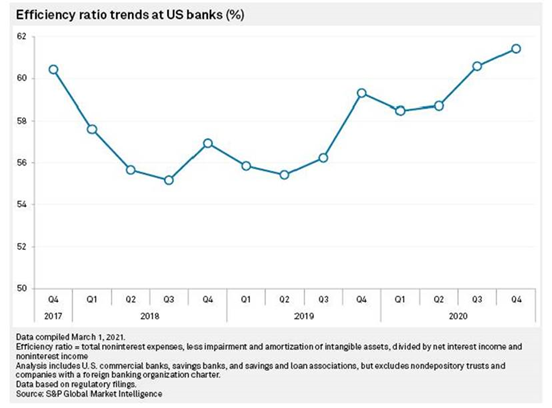

The aggregate efficiency ratio for U.S. banks continued to edge up in the fourth quarter, settling at 61.4% on Dec. 31. That's up from 59.3% at year-end 2019 and 56.9% for 2018. The trend is being driven by increasing expenses and slack revenue growth, according to this week's complimentary post from S&P Global's Market Intelligence. Read all the details and view the charts here.

------------------------------

Barb Rehm

Senior Managing Director

IntraFi Network

Arlington VA

------------------------------

0 Comments

Join the Conversation! 🗣️✨

Be part of our community—sign up now to share your thoughts, connect with others, and stay in the loop!