Bonus Post: Deposit Pricing Pressure Heats Up After Slow Start

------------------------------

Neil Stanley

------------------------------

-------------------------------------------

Original Message:

Sent: 08-25-2022 16:44

From: Rob Blackwell

Subject: Bonus Post: Deposit Pricing Pressure Heats Up After Slow Start

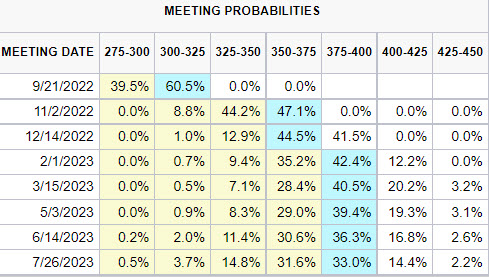

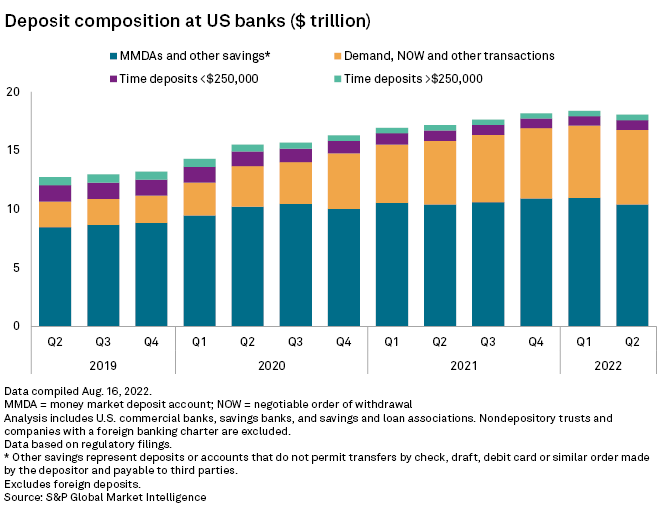

With a bonus article this week from our friends at S&P Global Intelligence, take a look at this article about the battle over bank deposits. It warns that competition for deposits is building among U.S. banks amid the Fed's continued interest rate hikes.

"Our models are showing that we're going to have probably more pricing sensitivity than we have in the last 15 or so years," Matt Pieniazek, President and CEO of Darling Consulting Group, citing factors including the scale and speed of the Fed hikes, told S&P. He goes on to say that banks have a "lot of money that looks like its core deposits" that isn't, noting all the readily available alternatives with higher yields than deposits, including one-year Treasuries paying more than 3%. The entire article is well worth your time.

------------------------------

Rob Blackwell

Chief Content Officer and Head of External Affairs

IntraFi

Arlington, VA

------------------------------