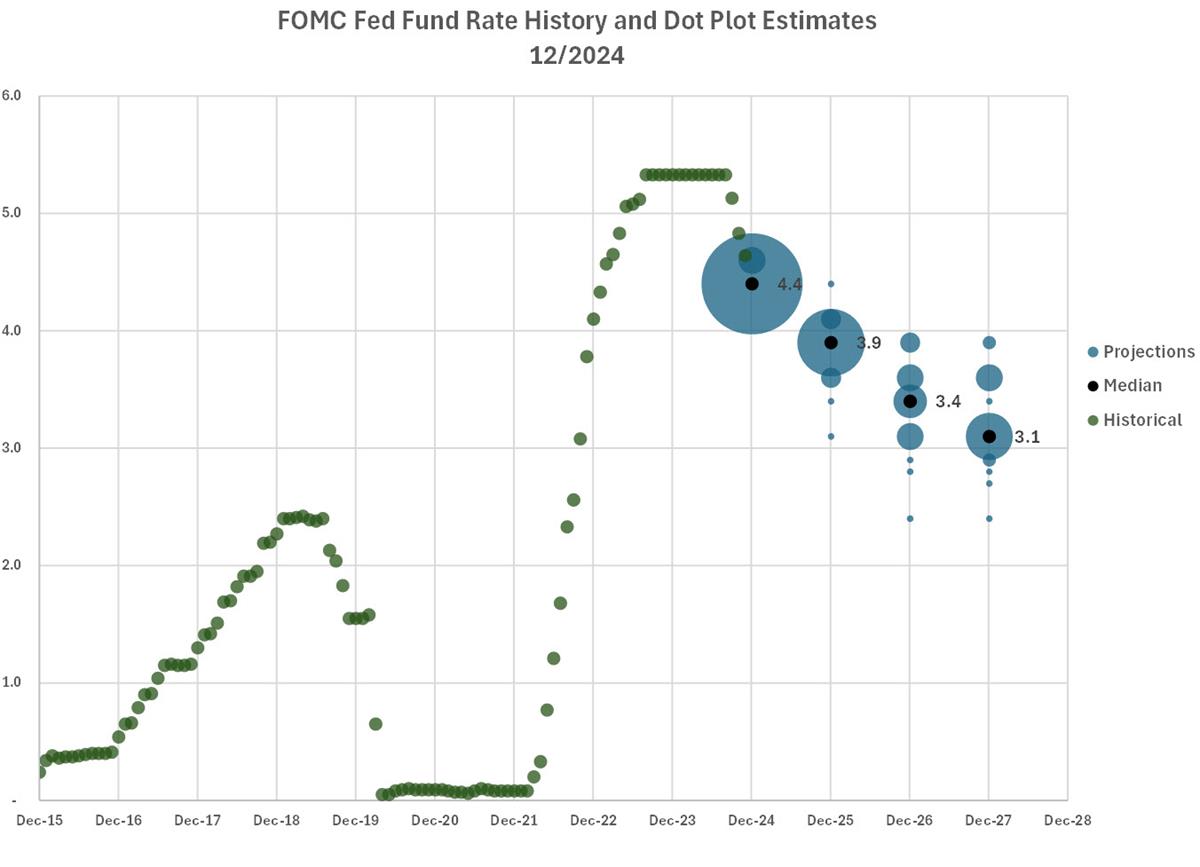

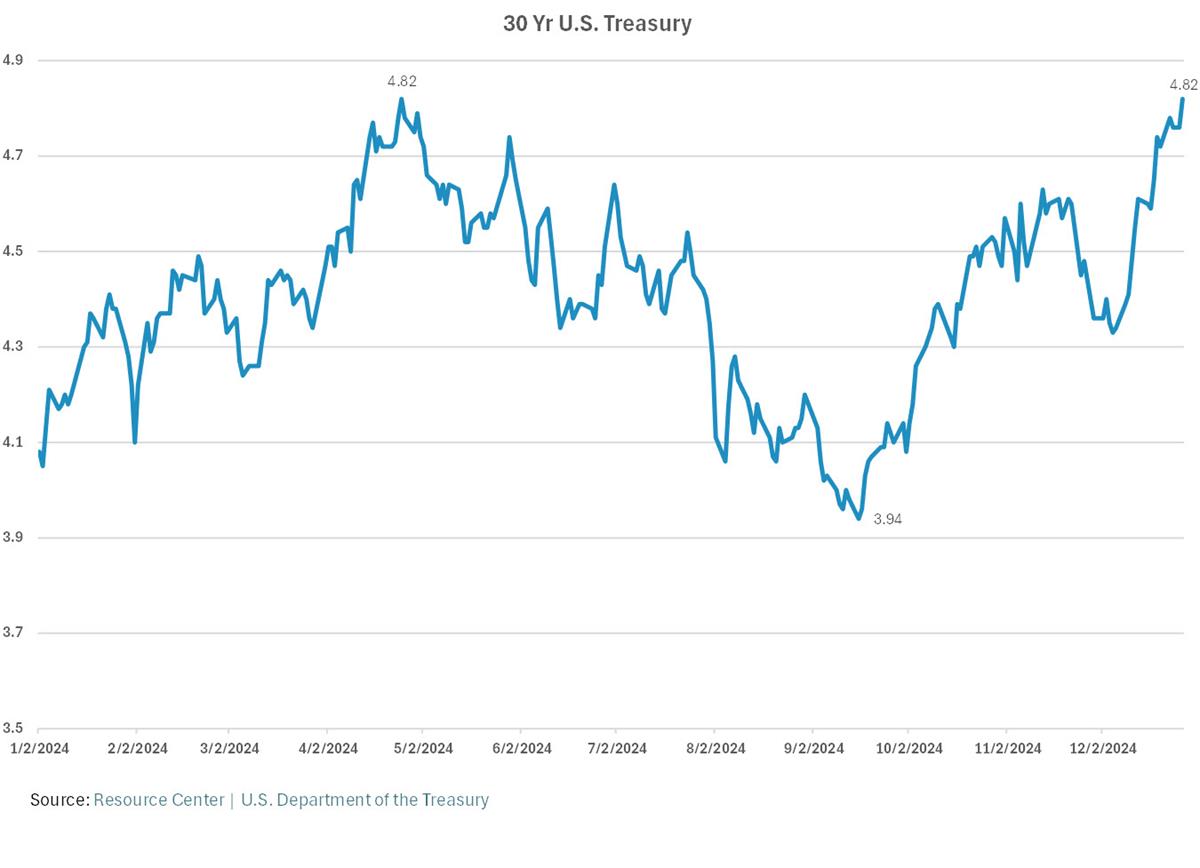

30-Year U.S. Treasury hits YTD 2024 Yield High of 4.82%

------------------------------

Neil Stanley

------------------------------

-------------------------------------------

Original Message:

Sent: 12-30-2024 10:10

From: John Tyson

Subject: 30-Year U.S. Treasury hits YTD 2024 Yield High of 4.82%

Neil - in light of the slower rate cuts now expected from the FOMC in 2025, how do you see Treasury yields moving in 2025?

------------------------------

John Tyson

CFO;Chief Financial Officer - CFO

Altamaha Bank & Trust Company

Vidalia, GA

------------------------------

Original Message:

Sent: 12-27-2024 17:05

From: Neil Stanley

Subject: 30-Year U.S. Treasury hits YTD 2024 Yield High of 4.82%

Seems the bond market is in learning mode.

------------------------------

Neil Stanley

------------------------------

I would like to see them review the 1071 rule.

-------------------------------------------

Original Message:

Sent: 11/18/2024 12:21:00 PM

From: Rob Blackwell

Subject: Tuesday Topic: The Next HFSC Chair Will Be …

The GOP officially won the House last week, completing its election sweep. That means, among other things, that leadership of the House Financial Services Committee will be changing. At this point, the race for the next HFSC chair appears to have narrowed to two men: Reps. Andy Barr, R-KY, and French Hill, R-AR. Both are ramping up their campaigns for the post and seeking to align their agendas with President-elect Donald Trump's.

While bankers are largely pleased with the election results, some have told me privately that the GOP under current HFSC Chair Patrick McHenry, R-NC, focused too much on digital assets and crypto instead of helping community banks.

Those in the race make nods to crypto, but appear more focused on banking. Barr wants to dial back regulations, reform the CFPB, and address the housing crisis through market-based approaches. Hill has an explicit proposal to "make community banking great again," including by reversing "the weaponization of the government."

Both candidates joined Banking with Interest earlier this year to discuss how they would approach chairing the HFSC. To familiarize yourself with their agendas, listen to the conversation with Rep. Andy Barr here and the conversation with Rep. French Hill here.

Which priorities would you like to see the next chair of the HFSC pursue?

------------------------------

Rob Blackwell

Chief Content Officer and Head of External Affairs

IntraFi

Arlington, VA

------------------------------